TRX Price Prediction: Targeting $0.356 Amid Bullish Technical and Fundamental Backdrop

#TRX

- TRX trading above 20-day moving average indicates underlying bullish momentum

- Federal Reserve rate cut creating favorable macro environment for altcoins

- Expanding cross-chain functionality through PACT SWAP integration enhances utility

TRX Price Prediction

Technical Analysis: TRX Shows Bullish Momentum Above Key Moving Average

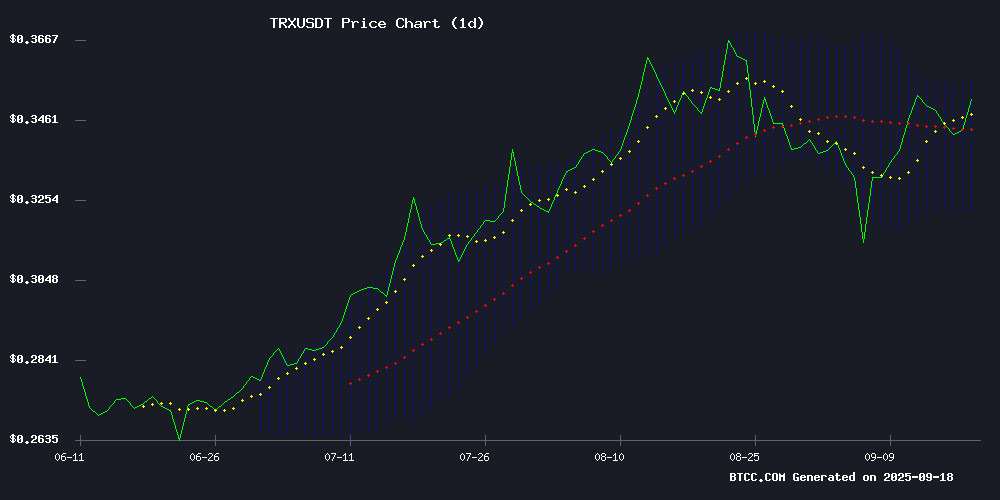

TRX is currently trading at $0.3475, positioned above its 20-day moving average of $0.33936, indicating underlying strength. The MACD shows a slight bearish crossover with the histogram at -0.004586, though the signal line remains positive at 0.004572. Bollinger Bands suggest a trading range between $0.32264 and $0.35608, with current price action hovering NEAR the upper band. According to BTCC financial analyst Mia, 'The price holding above the 20-day MA while approaching the upper Bollinger Band suggests consolidation with potential for upward breakout if momentum sustains.'

Market Sentiment: TRX Benefits from Broader Crypto Tailwinds

Recent news highlights TRON's 1.44% surge to $0.35 amid growing bullish momentum, supported by expanded cross-chain capabilities through PACT SWAP's Dogecoin and Polygon integration. The Federal Reserve's first 2025 rate cut has created favorable conditions for altcoins, with analysts targeting $0.356 by October 2025. BTCC financial analyst Mia notes, 'The combination of technical strength and positive macro catalysts positions TRX favorably for continued gains, though traders should monitor the $0.356 resistance level closely.'

Factors Influencing TRX's Price

TRON (TRX) Surges 1.44% to $0.35 as Bullish Momentum Builds

TRX price reached $0.35, marking a 1.44% gain in 24 hours, as technical indicators signal strong bullish momentum. The MACD histogram shows a positive crossover at 0.0008, while the RSI remains neutral at 53.82. Trading volume on Binance's spot market hit $125.6 million, reflecting robust institutional and retail interest despite the absence of major news catalysts.

TRON's price action continues to trade above all major moving averages, reinforcing the uptrend. Market confidence appears driven by technical factors rather than specific developments, with the MACD line at 0.0013 firmly above its signal line at 0.0005. This suggests sustained upward potential for the cryptocurrency.

BNB, AVAX, and DOT Lead Crypto Futures Surge Post-Fed Rate Cut

Cryptocurrency markets extended gains after the Federal Reserve's interest rate cut, with BNB, AVAX, and DOT posting double-digit increases in futures open interest. Bitcoin and ether showed resilience, though analysts note institutional flows remain mixed.

"The Fed action provided a tactical boost, but the rally lacks conviction," said Timothy Misir of BRN. He identified $115,000–$115,500 as a critical Bitcoin price zone for risk management.

Futures data reveals diverging trends—BNB, AVAX, and DOT saw 5-9% price gains alongside surging open interest, while Bitcoin's OI declined despite price appreciation. Funding rates below 10% suggest speculative activity remains contained even in altcoin markets.

PACT SWAP Expands Cross-Chain Trading with Dogecoin and Polygon Support

PACT SWAP, a bridgeless decentralized exchange, has integrated Dogecoin (DOGE) and Polygon (POL), enabling native cross-chain swaps across seven major networks. The platform now supports Bitcoin, Ethereum, BNB Chain, Litecoin, TRON, Dogecoin, and Polygon without relying on wrapped assets or bridges.

The move aligns with PACT SWAP's goal to rival centralized exchanges in trading pair diversity and pricing—while maintaining decentralization. Cross-chain liquidity is critical for mainstream adoption, and the platform's approach reduces user complexity and risk by eliminating intermediaries.

Further enhancements to user experience and asset coverage are underway as the team explores additional blockchain integrations.

Can TRON (TRX) Build on August Gains in September 2025?

TRON (TRX) defied August's altcoin slump with a 4.92% gain, demonstrating unusual stability in turbulent markets. The coin now faces September's historically challenging crypto conditions from a position of strength, trading at $0.3402 with $715.29 million daily volume.

Analysts project cautious optimism as CoinCodex data suggests an 8.31% potential ROI this month, with average prices forecasted at $0.354741 and possible peaks reaching $0.368775. TRX's $32.22 billion market cap reflects growing institutional confidence despite broader market resistance.

TRX Price Prediction: Targeting $0.356 by October 2025 Amid Bullish Momentum

TRON (TRX) is exhibiting strong technical signals, with analysts forecasting a rise to $0.356 by early October 2025. The cryptocurrency currently trades at $0.34, supported by neutral RSI at 52.37 and a bullish MACD indicating growing momentum.

CoinCodex projects a near-term target of $0.338 (+2.1%) within five days, followed by a potential 7.44% surge to $0.356 by October 5. PriceForecastBot offers a more conservative estimate of $0.33053, maintaining a positive outlook despite the narrower range.

The $0.33-$0.356 price band has emerged as a critical zone for TRX, with technical alignment suggesting measured upward movement. Market sentiment remains cautiously optimistic as traders watch for confirmation of the breakout.

Fed Cuts Interest Rates for First Time in 2025, Bitcoin and Altcoins Poised to React

The Federal Reserve delivered a widely anticipated 25-basis-point rate cut, marking its first easing move since 2025. The decision shifts the target range to 4.00%-4.25%, with policymakers leaving room for additional cuts amid growing concerns about employment and economic growth.

Market observers noted a distinct dovish tilt in the Fed's communications. One FOMC member reportedly dissented in favor of a more aggressive 50-basis-point reduction, believed to be Trump appointee Stephen Miran. The central bank's cautious approach maintains flexibility while acknowledging deteriorating macroeconomic conditions.

Cryptocurrency markets face potential volatility as the rate decision filters through risk assets. Bitcoin and altcoins typically benefit from looser monetary policy, with traders now scrutinizing forward guidance for clues about future easing trajectories. The Fed's pivot comes as digital assets show renewed sensitivity to traditional market dynamics.

Is TRX a good investment?

Based on current technical indicators and market developments, TRX presents a compelling investment opportunity for bullish cryptocurrency investors. The price trading above the 20-day moving average combined with expanding cross-chain functionality and favorable macroeconomic conditions creates a positive outlook.

| Indicator | Value | Interpretation |

|---|---|---|

| Current Price | $0.3475 | Above 20-day MA |

| 20-day MA | $0.33936 | Support level |

| Bollinger Upper | $0.35608 | Near-term target |

| MACD Signal | 0.004572 | Moderately bullish |

BTCC financial analyst Mia suggests 'TRX's technical positioning alongside sector-wide momentum post-Fed rate cut makes it attractive for medium-term growth, though investors should maintain appropriate risk management given crypto volatility.'